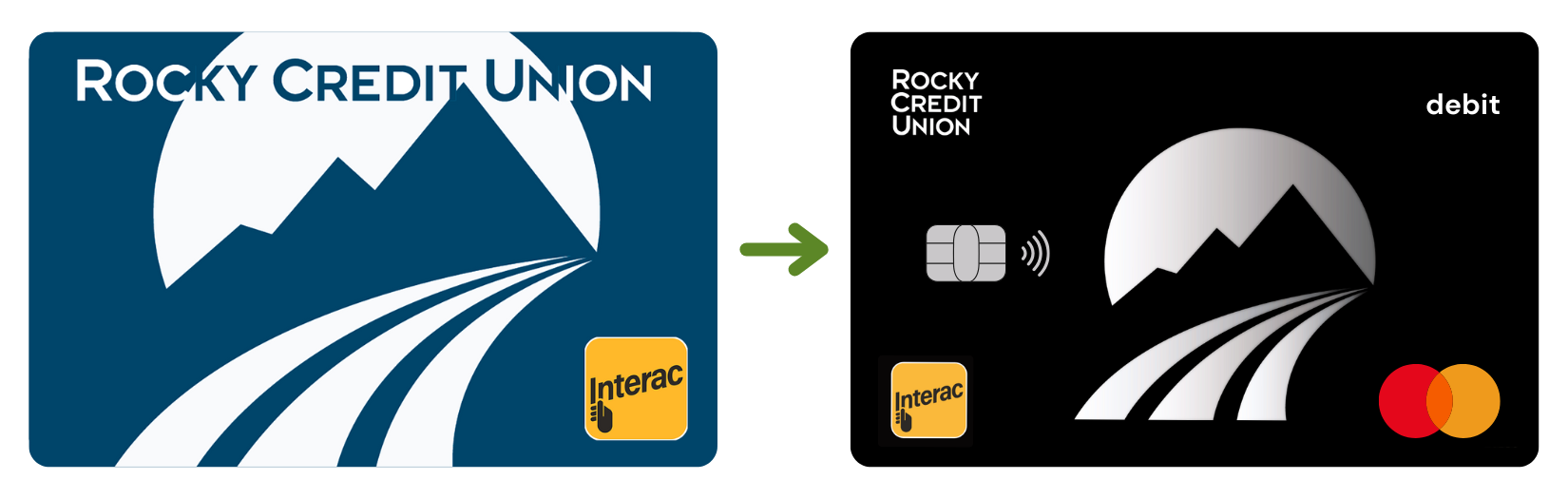

Debit Mastercard®

- Use it for online, in-store & international purchases

- Use it for in-app purchases

- Use it for recurring payments

- Tap to pay using the Interac Flash® technology

Most Common Questions

Getting Started with RCU Debit Mastercard®

If you’re an existing debit card holder, you can expect to receive a new Debit Mastercard® to replace your expiring debit card close to your card expiry date.

If you’re a new member, you’ll get a new Debit Mastercard® when you open a new account and request card access.

If you’re an existing member but currently do not have a debit card, you may request a new Debit Mastercard® anytime by calling our Member Services department at 403-845-2861 or visiting the branch in person.

You must use a Chip/PIN transaction when a new card is issued before Tap will be available to use. You will NOT be able to make an online purchase until you have completed a Chip/PIN transaction.

Remember to destroy your existing debit card once your new Debit Mastercard® has been activated. Activate your new card soon after it arrives, as your old debit card will be deactivated 60 days after your new card arrives in the mail.You may receive an additional envelope with a new PIN (a new pin mailer). If not, your PIN will be the same as your previous debit card.

You can change the PIN in-branch or at the ATM.

If you forget your PIN, we can help! Simply visit us in-branch.

You may continue to login to your online banking platform with your existing username and password.

If you previously used your debit card number, we encourage you to visit your local branch or contact the Member Services department at 403-845-2861 to set up a username for online banking purposes.

If you currently have an active debit card, you will be provided with a new Debit Mastercard® at some point in the next few years, depending on your expiry year.

If you’d like to replace your debit card with a new Debit Mastercard® right away, we can help. Simply call our Member Services department 403-845-2861 or visit us in branch to request a new card.

Canadian Merchants Online, Over the Phone, and By Mail

• Debit Mastercard® is accepted online and in mobile apps, over the phone, and by mail at participating merchants in Canada.

• It can also be used to pay for any recurring payments you may have (e.g., Netflix, Amazon, subscription services, etc.) and even for paying your monthly bills (e.g., Enmax, Shaw, Telus, etc.).

International Merchants (Including US) Online, Over the Phone and By Mail

• Debit Mastercard® is accepted by US and international retailers that accept Mastercard online, in mobile apps, by telephone and mail order.

In Stores Outside Canada

• When shopping in stores outside of Canada, Debit Mastercard® is accepted wherever Mastercard is accepted. Look for the Mastercard acceptance mark.

Note: The payment methods for eCommerce (online transactions) are determined by the retailer, so some online retailers may not accept payments by Debit Mastercard®. Please check the retailer’s website to confirm accepted payment methods.

Using your RCU Debit Mastercard®

When completing your online purchase, select Debit Mastercard® or Mastercard as the payment/card type. Although the Debit Mastercard® is not a credit card, it acts as one when making online purchases.

You’ll need to enter your Debit Mastercard number, expiry, and security code (CVV found on the back of the card) in the required fields.

Note: Accepted payment methods for online retailers or eCommerce sites are determined by the retailer, so some online retailers may not accept payments by Debit Mastercard®. Please check the retailer’s website to confirm accepted payment methods.

Debit Mastercard® is accepted at millions of merchants worldwide and can be used for purchases made in store, online, over the phone and by mail. When shopping outside of Canada look for the Mastercard acceptance mark. Please note, point-of-sale Interac Flash tap payments are only accepted within Canada. International payments require a PIN transaction.

Acceptance experience may vary from one country to another and will typically require either a PIN or signature to process transactions at points of sale.

In Canada

Yes, Debit Mastercard® works at Canadian ATMs, but the transaction will be processed by Interac. Like with your debit card, you simply insert the card into the ATM, enter your PIN, and select the desired function (withdraw cash, make deposits, transfer funds, check account balances).

Outside Canada

Debit Mastercard® can be used to withdraw funds directly from your bank account at more than 2.2 million ATMs around the world where Mastercard is accepted. Just look for the Mastercard acceptance mark.

Think of your RCU Debit Mastecard® as a debit card, but with added features so you can complete transactions that were only once possible with a credit card – things like hotel reservations, online purchases, and in-app purchases.

Transactions made on your Debit Mastercard® come directly out of your chequing or savings account, not on credit. Because of this, there’s no due dates or payments to worry about.

IMPORTANT TO NOTE***: Some hotels do not take DEBIT/CASH make sure you check into these details on their website or call ahead. It will allow you to book online; however, once you get there, if they do not accept debit, you are unable to pay & complete the transaction; & not able to have them hold funds for security deposit. This is considered a DEBIT card when in hand; processes like a credit card when you are purchasing online. If you prepay for the hotel, then it will settle & go through, but you will still need another form of payment (credit card) for the damage deposit if they don’t accept debit.

Because it is tied to your chequing or savings account and is not a credit product, your Debit Mastercard® does not affect your credit score in any way.

If you’re interested in solutions to help build your credit, talk to our professional staff by calling Member Services at 403-845-2861 or visit us in branch @ 5035 49 Street.

Understanding Transactions, Holds, and Card Limits.

It’s important to note that eCommerce or online transactions will work for both chequing & savings accounts, whichever account is linked to your Debit Mastercard®. You may still use it for ATM and point-of-sale transactions, and applicable surcharges may apply.

All ATM and point of sale (POS) transactions completed within Canada are processed the exact same way as your existing debit card.

Transactions completed via eCommerce (online), telephone, or International POS are processed on the Mastercard® network. This means that transactions will process similar to how credit card transactions are processed. At the time of purchase, a hold is placed on your account for the amount of the purchase or pre-authorization. When the merchant processes their card transactions or when the order has been fulfilled, the purchase will debit your account and the hold will be released.

The purchase amount will be held until the merchant processes their card transactions and your account is debited. Depending on the merchant, it can take 1-2 days on average for a purchase to clear through your account. Some retailers can take up to 5 days. The hold amount will affect your available balance.

This is similar to a pending transaction that you would see on your credit card, which can take several business days to post.

The limit on your Debit Mastercard® is determined based on the available balance in your account, including available overdrafts, attached line of credit, etc.

You can check your real-time account balance through online banking, or by visiting the branch or by calling Member Services at 403.845.2861.

Yes! The daily transaction limits for ATM or chip-and-pin point of sale transactions can be adjusted on your Debit Mastercard®. You can do this by coming into the branch or by calling Member Services at 403.845.2861.

Please note that we’re currently unable to adjust your contactless limit (i.e., Interac Flash) but this can be disabled upon request.

Protecting Yourself and your Debit Mastercard®

Your RCU Debit Mastercard® is covered by Interac® and Mastercards® zero liability policy, which means you won’t be liable for any unauthorized transactions that occur using your Debit Mastercard® where you have:

-

Exercised reasonable care in safeguarding your debit card and PIN from any unauthorized use, loss, or theft

-

Immediately reported to RCU any loss or theft of the Debit card

-

Notified RCU of the unauthorized transactions within a reasonable time

- Temporarily lock your debit cards to prevent all future transactions.

- Lock POS transactions to restrict all point-of-sale purchases within Canada.

- Lock international POS transactions to restrict all point-of-sale purchases outside of Canada.

- Lock ATM transactions to restrict all ATM withdrawals performed within Canada.

- Lock international ATM transactions to restrict all ATM withdrawals performed outside Canada.

- Set worldwide ATM and POS "per-transaction" limits for withdrawals and purchases.

- Lock contactless payments to restrict "tap" and in-app mobile transactions.

- Lock contactless smart card transactions to restrict NFC and "tap" flash payments.

- Turn on text notifications for attempted use of a locked card.

Using your Mobile Wallet

Members can pay with Apple Pay when connecting their Interac® Flash Debit Card to their Apple Wallet, after downloading the latest version of the RCU Banking app. Once you've linked an active flash card to Apple Pay, you can use it at any location where Interac® Flash is available in Canada.

Apple Pay is for iOS users who use debit frequently for payment, and want a secure, contactless payment functionality with all the benefits of Interac® Flash, and the added convenience of securely paying for purchase without your member card.

How to Install Apple Pay to Your iPhone, right from your RCU mobile app:

- Download the latest RCU(if you haven't already!) onto your Apple iPhone. iOS version 11 or greater, and iPhone 6 or greater are required.

- Log in to your digital bank account.

- Click on the 'More' tab in the mobile app, then click on 'Apple Pay'.

- Click 'Add to Apple Wallet' beside the card you wish to add and follow the screen prompts.

- You will receive a success message upon completion and your card is ready to use for Apple Pay!

How to Use it Once Installed:

- Hold your unlocked iPhone near the payment pad.

- Follow the instructions on the screen.

- Use your Touch ID, Face ID or device passcode to complete the payment then watch for your purchase to be approved.

Members can make quick and easy contactless payments with Google Pay on their Android devices. Online, in apps or in physical stores, use your Android device to make everyday purchases anywhere that the following symbols are displayed.

How to set up Google Pay:

- Download or open the Google Pay app.

- Follow the instructions to add your member card.

How to pay in stores with Google Pay:

- Simply unlock your phone (you don't even need to open the app).

- Hold the back of your device to the payment terminal.

- You'll see a check mark on your screen when payment is successful.

How to pay in-apps with Google Pay:

- Once you've added your card to a device, there's no need to enter your payment info at checkout.

- Just select the option of 'Google Pay', confirm your purchase and you're all set.

Members, you can swipe up from the home button on your Samsung Android device for a simple way to access your RCU debit card. Purchases can then be authenticated with your PIN, iris or fingerprint* before tapping your phone over a POS terminal. Samsung Pay can be used at merchant terminals where you can tap, scan or swipe a payment card.

How to set up Samsung Pay:

- Make sure you own a compatible Samsung Phone or Watch.

- Samsung Pay should be preloaded on any available Samsung phone, but it can easily be re-installed by visited your Google Play Store.

- Open the Samsung Pay app and tap 'Get Started'.

- Enter a PIN for Samsung Pay, and then enter it again to confirm.

How to make retail purchases with Samsung Pay:

- Select the Samsung Pay app icon on swipe up from the bottom of your Samsung Android device.

- Authenticate your identity easily using your iris, fingerprint or by entering your PIN.

- Hold your phone over any POS terminal accepting payment cards that tap, swipe or scan.

- If its your first time using Samsung Pay, you will be asked to add payment cards. Follow the prompts to do this.

If you’ve recently received your new Debit Mastercard® and would like to add it to your digital wallet you can set it up yourself, visit our branch or call our Member Services department at 403.845.2861

To make contactless payments with your Mobile Wallet, you must use a screen lock on your device for your security.

You can unlock your Mobile Wallet with several methods:

- PIN

- Pattern

- Password

- Fingerprint

- Iris scan

- 3D face unlock

Search

Search

www.google.com

www.google.com